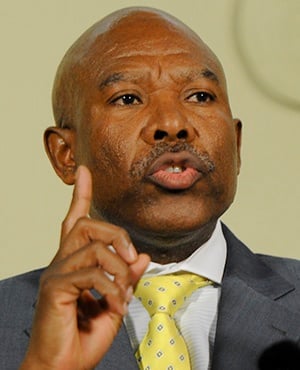

SARB governor Lesetja Kganyago. (Photo: File, Gallo Images)

"We have spent too much of the year indulging in populism instead of making pragmatic choices," Kganyago said in in the foreword to the central bank’s Monetary Policy Review released on Monday in Pretoria. "A particular concern for me has been the amount of time we have squandered discussing Reserve Bank nationalisation."

The African National Congress decided in December that the Reserve Bank should be state-owned, like most other central banks. In August, the Economic Freedom Fighters, a political party which has won support by vowing to nationalise everything from land to banks, tabled a bill to change the ownership.

"No one can explain what South Africa will gain from this step, or why it would justify the potential costs," Kganyago said.

"Clearly this subject excites some passion, so we keep talking about it, but it is the wrong priority. If we are serious about South Africa’s economic performance, we need to be more focused in our agenda-setting."

Africa’s most-industrialised economy hasn’t expanded at more than 2% annually since 2013 and fell into a recession in the second quarter. Without the appropriate reforms, growth is likely to stay muted, according to the Monetary Policy Review.

President Cyril Ramaphosa announced a stimulus plan to boost growth and confidence in September and Finance Minister Tito Mboweni said last week funds will be reallocated to faster-spending programmes.

These steps are unlikely to significantly alter the nation’s growth trajectory, according to Fitch.

While the large budget deficit could help boost domestic demand, tax increases that were announced in February may have the opposite effect, the central bank said.

"Given this mix of stimulatory and contradictory elements, fiscal policy is perhaps best described as having one foot on the brake and the other on the accelerator," it said.

Source: Fin24's

Comments

Post a Comment